So, you’re an estate manager in Nigeria, juggling maintenance requests, resident complaints, and oh yeah, trying to keep the lights on (literally). Your inbox is overflowing with overdue invoices, and your spreadsheet is a chaotic mess of numbers.

Does this sound familiar?

If so, you’re one out of the 70% of managers enduring this constant juggling act. It’s true that financial management is one of the biggest headaches for estate managers across the country. From tight budgets to unpredictable expenses, keeping your community financially healthy can feel like the most hectic thing in the world. But guess what? It doesn’t have to be. With the right strategies and tools, you can take control of your estate’s finances, reduce stress, and even find some hidden cost-saving opportunities. This is what the remaining 20% of managers are doing to thrive. You too can!

This guide will walk you through proven strategies and tools to navigate the complexities of estate finances, ensuring your community thrives without breaking the bank.

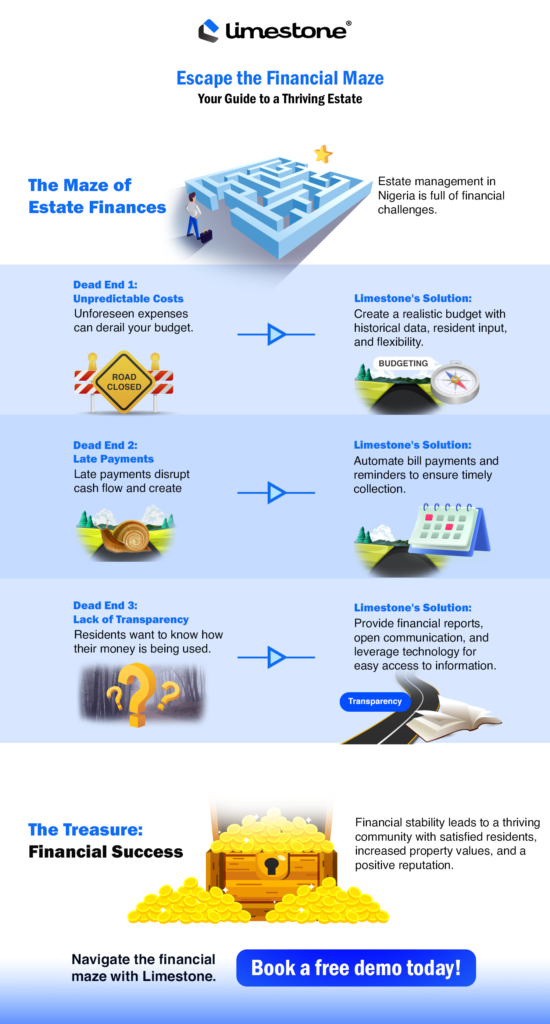

1. Budgeting: Your Financial Roadmap

Think of your estate’s budget as a detailed map, guiding you through the financial terrain. It helps you anticipate expenses, allocate resources wisely, and avoid those unexpected potholes that can derail your plans.

Crafting a realistic budget requires a proactive approach and a deep understanding of your estate’s unique needs. Here’s how to create a budget that actually works:

- Historical Data is Your Friend: Analyze past expenses and revenue to identify trends and forecast future needs. Look for patterns in utility costs, maintenance expenses, and resident payments to inform your budget allocations.

- Resident Input is Invaluable: Engage with your residents to understand their priorities and expectations. This could involve surveys, town hall meetings, or online forums through platforms like Limestone. Their insights can help you allocate funds effectively and ensure everyone feels heard.

- Realistic is the Name of the Game: It’s easy to get carried away with ambitious projects but be sure to ground your budget in reality. Factor in inflation, unexpected repairs, and potential economic fluctuations.

- Flexibility is Key: Build some wiggle room into your budget for unforeseen expenses. A contingency fund can be a lifesaver when unexpected costs arise.

2. Cost-Saving Strategies: Stretch Your Naira Further

We know that every Naira counts, especially in today’s economic climate. But cutting costs doesn’t have to mean sacrificing quality or resident satisfaction.

Here are some clever strategies to maximize your resources:

- Negotiate like a Pro: Don’t be afraid to haggle with vendors! Shop around, compare prices, and negotiate contracts to get the best deals on services and supplies.

- Embrace Preventive Maintenance: Addressing small issues early can prevent major (and expensive) repairs down the line. Schedule regular inspections and maintenance for critical systems like plumbing, electrical, and elevators (if your property uses one).

- Go Green: Invest in energy-efficient technologies and practices to reduce utility costs and minimize your environmental impact. Solar panels, LED lighting, and water-saving fixtures are just a few options to consider.

- Bulk Up: Buy supplies in bulk to get discounts and avoid frequent trips to the market. This can save both time and money in the long run.

- Community Collaboration: Tap into the power of your community! Encourage residents to volunteer for tasks like gardening, cleaning, or organizing events. This fosters a sense of ownership and can significantly reduce labor costs.

3. Transparency & Accountability: Build Trust, Avoid Drama

Financial transparency is the foundation of a healthy relationship with your residents. When people understand how their money is being used, they’re more likely to trust your decisions and feel invested in the community’s success.

Here’s how to maintain financial transparency:

- Regular Financial Reports: Share clear and concise reports with residents, outlining income, expenses, and any major financial decisions. Use visuals like charts and graphs to make the information easy to understand.

- Open Communication Channels: Be proactive in addressing any questions or concerns about finances. Utilize platforms like Limestone’s community forum to facilitate open dialogue and transparency.

- Technology for the Win: Leverage tools like Limestone to provide easy access to financial information and simplify payment processes. This not only saves you time but also empowers residents to take control of their finances.

You Have a Financial Management Ally

We understand the unique challenges of estate management in Nigeria. That’s why Limestone offers a suite of features designed to streamline your financial operations and foster transparency:

- Automated Bill Payments: Reduce late payments and administrative headaches.

- Real-Time Financial Reporting: Get instant insights into your estate’s finances.

- Transparent Communication: Keep residents informed and engaged.

Financial Success is Within Your Reach

Financial worries don’t have to keep you up at night. With a solid budget, smart cost-saving strategies, and a commitment to transparency, you can achieve financial success for your estate.

Ready to take control of your finances and build a thriving community?