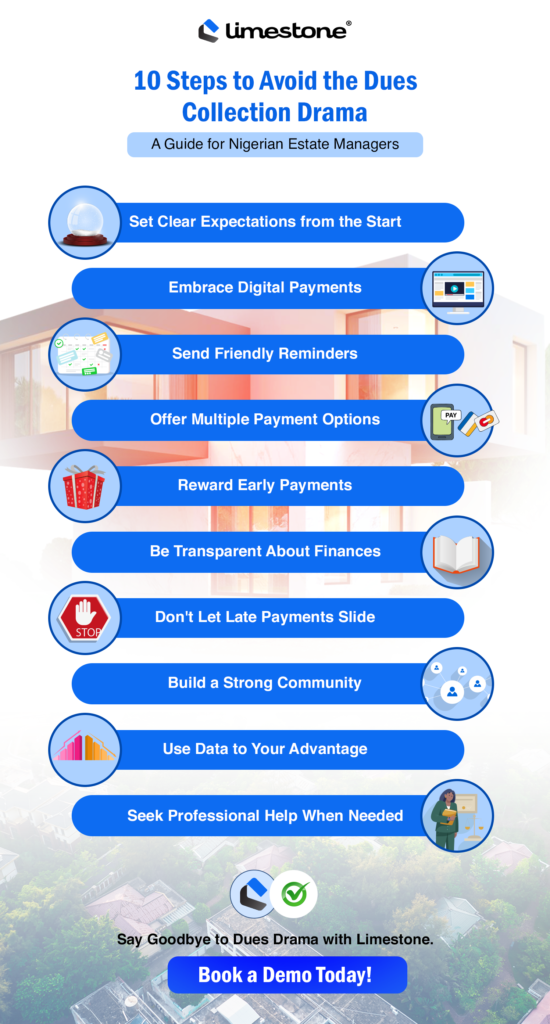

Let’s be real, being an estate manager in Nigeria sometimes feels like being a debt collector. Late payments, endless reminders, and the awkwardness of chasing down neighbors for their dues… it’s enough to make anyone want to JUST QUIT. We totally understand what it feels like to constantly have your inbox overflowing with excuses instead of payments. “Network is down,” “I forgot my password,” “Oga I’ll pay next week, I promise!” Do all these sound familiar?

Chasing after dues is every estate manager’s least favorite pastime. It’s time-consuming, frustrating, and can strain relationships with residents.

So, how do you transform bill payments from a dreaded chore into a smooth, stress-free process? We’ve got you covered. In this blog post, we’re sharing 10 proven strategies that’ll help you boost collections, improve cash flow, and keep your residents happy (and their wallets open).

1. Set Crystal-Clear Expectations from the Start

Remember that first date? (Hopefully, it went better than your last dues collection attempt.) Just like in any relationship, setting clear expectations from the get-go is key. Make sure your lease agreements or contracts clearly outline payment deadlines, acceptable payment methods, and any late fees.

2. Embrace the Digital

Paper invoices? They’re so 2005. It’s time to join the digital age. Online payment platforms (like the one built into Limestone!) make it easy for residents to pay with a few clicks, reducing the risk of lost checks and forgotten payments.

3. Reminders That Don’t Feel Like Nagging

Nobody likes a nag, but everyone appreciates a gentle nudge. Set up automatic payment reminders via email or SMS a few days before the due date. Keep the tone friendly and helpful, not demanding.

4. Offer Multiple Payment Options (Because Flexibility is Key)

Some people swear by bank transfers, others are all about mobile money. Cater to different preferences by offering a variety of payment options. The easier you make it to pay, the more likely people will do it on time.

5. Rewards? Yes, Please!

Who doesn’t love a little incentive? Offer small discounts or perks for early payments. It’s a win-win: you get your money faster, and residents feel appreciated.

6. Transparency is Your Best Friend

Ever been frustrated by a lack of communication from your bank? Your residents feel the same way about their estate finances. Be transparent about how dues are used, share regular financial reports, and make it easy for residents to access their payment history.

7. Don’t Let Late Payments Slide

While you want to be understanding, it’s important to have a clear late payment policy in place. Communicate it clearly from the start and enforce it consistently. This sets expectations and discourages chronic late payers.

8. Build a Community, Not Just a Collection of Homes

When residents feel connected and invested in their community, they’re more likely to pay their dues on time. Organize events, create opportunities for interaction, and foster a sense of belonging.

9. Data is Your Superpower

Use technology to track payment patterns and identify potential issues early on. Limestone’s analytics dashboard gives you insights into who’s paying on time, who’s struggling, and where you might need to adjust your strategies.

10. When in Doubt, Get Help

Sometimes, despite your best efforts, you’ll encounter difficult situations. Don’t be afraid to seek professional advice from lawyers or financial experts to ensure you’re handling things correctly and legally.

Say Goodbye to Dues Drama

Collecting dues and bills doesn’t have to be a constant battle. By implementing these strategies and leveraging the power of technology like Limestone, you can create a smoother, more efficient process that benefits everyone.

Ready to transform your estate’s financial health? Book a Demo with Limestone today!